Background

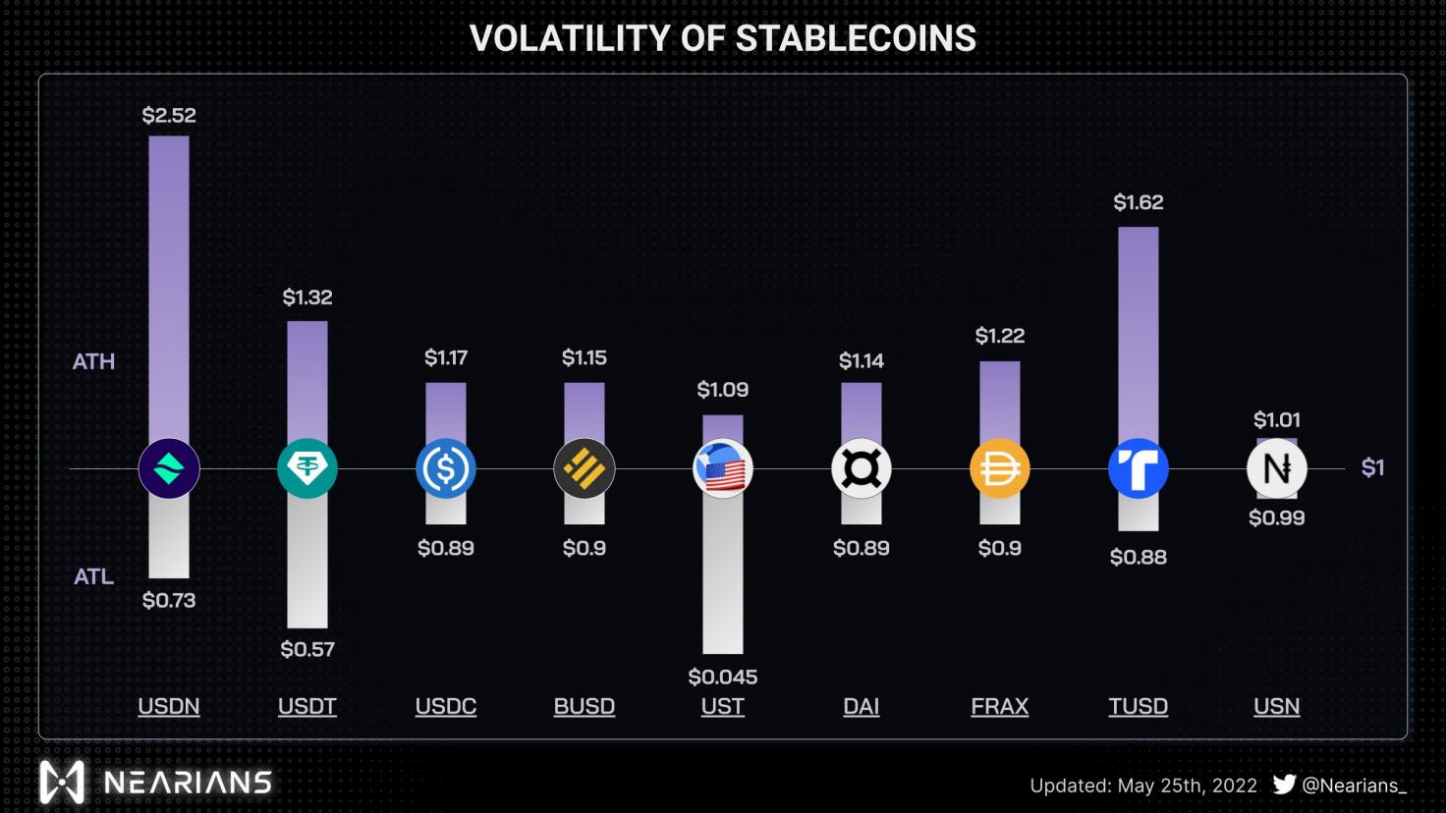

In May 2022, UST and LUNA, which once recorded a total market cap of over $40 billion, collapsed overnight, and plenty of users suffered huge losses as a result. Following the crash, algorithmic stablecoins have once again become a popular crypto topic. USN, a stablecoin native to an emerging public chain named NEAR, was launched almost at the same time as UST collapsed. The fall of UST showed this nascent stablecoin how the death spiral of an algorithmic stablecoin can engulf and destroy everything like a terrifying black hole, and users also wonder whether USN could avoid a similar ending in the future.

About USN

As the first NEAR-native algorithmic stablecoin, USN is soft-pegged to the US Dollar and backed by a Reserve Fund that contains collaterals such as NEAR and USDT. USN is positioned to be an effective way to bootstrap liquidity in the NEAR ecosystem while adding a new layer to NEAR’s utility as a token. USN’s core stability mechanisms consist of on-chain arbitrage and the Reserve Fund based on the Currency Board principle. Decentral Bank (https://decentral-bank.finance/), the DAO developing and supporting USN, manages the smart contracts of $USN and its Reserve Fund. The DAO can vote to stake the NEAR from the Reserve Fund and distribute the staking rewards to the users of protocols that integrate USN.

USN’s issuance mechanism

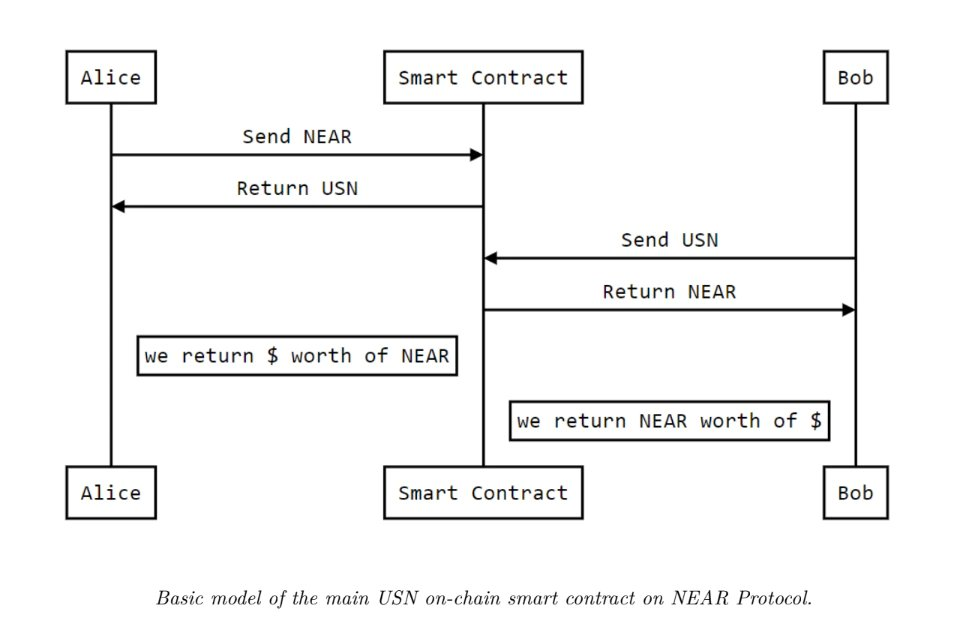

The initial supply of USN is double-collateralized by NEAR and USDT via the Reserve Fund. Decentral Bank issues the initial supply of USN through over-collateralization of the initial collateral (NEAR) at a ratio of 2:1. Subsequently, the new USN will be directly minted with NEAR or other stablecoins at a 1:1 ratio. In other words, after initial issuance, users can mint new USD with NEAR or other stablecoins at a 1:1 ratio, and they can also directly convert NEAR into new USN in the Sender wallet. However, unlike Terra’s UST minting mechanism, NEAR used for such conversions is not directly burned but will be channeled into Decentral Bank’s Reserve Fund. Meanwhile, when USN is burned, an amount of NEAR that’s worth the equivalent value will be added, which resembles UST’s burning mechanism.

Pegging mechanism

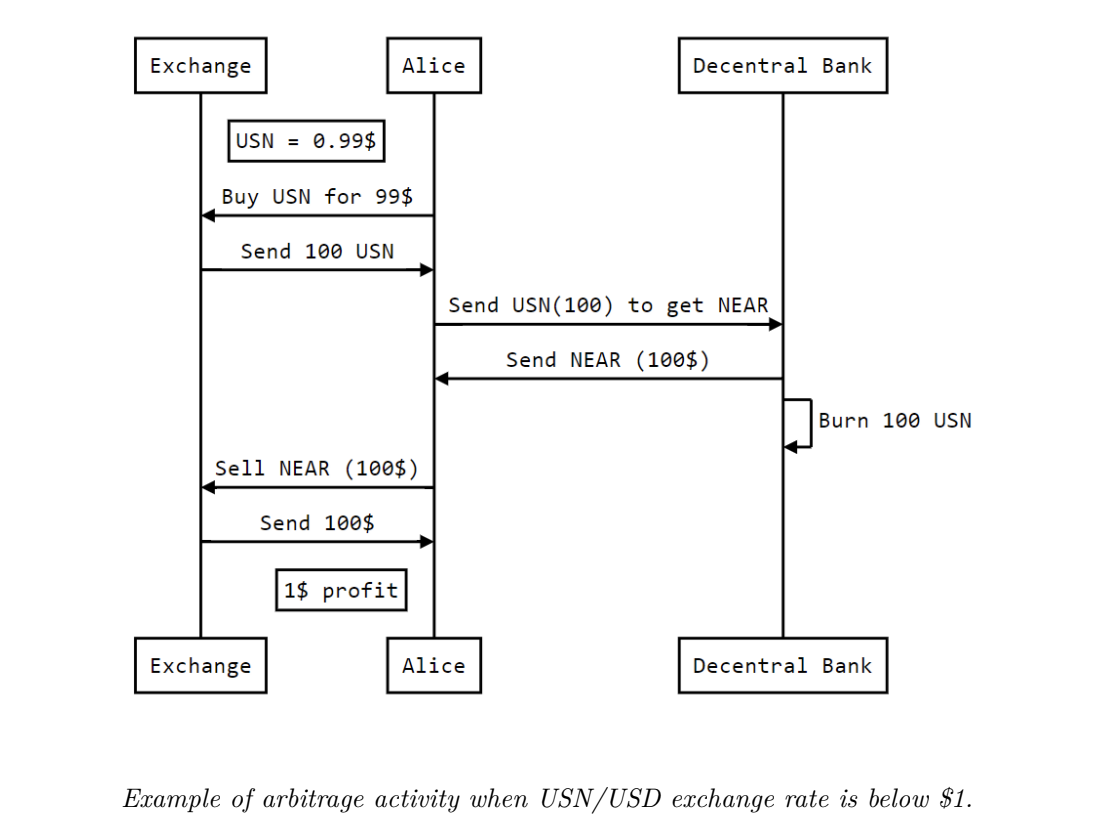

USN’s 1:1 peg to the US Dollar is secured through on-chain arbitrage and the Reserve Fund. USN maintains its peg through a smart contract which allows for the exchange of NEAR for USN with 0 slippage and minimal commissions. As soon as USN loses its peg, arbitrageurs will exploit the price difference between NEAR\USN and NEAR\USD until USN returns to its peg. At its launch, a part of the USN supply will be deposited into Ref Finance’s StableSwap to improve the stablecoin’s liquidity through liquidity mining incentives.

Automation of Treasury Management

Automation of Treasury Management is a design unique to USN. Every USN issued is backed by the corresponding collateral that’s stored in the Reserve Fund. Decentral Bank, the manager of the Reserve Fund, manages such collaterals through NEAR-based smart contracts. These on-chain contracts automatically execute Treasury Management strategies so that they could perform dynamically configurable, real-time small-volume transactions to avoid any severe imbalances in the Reserve Fund. According to USN’s whitepaper, the primary Treasury Management strategies are as follows: When the NEAR price rises to the point where the upward trend slows down, Decentral Bank would sell NEAR to balance the assets of the Fund. Conversely, it would buy NEAR when the price drops to a point where the downward trend slows down. With this design, Decentral Bank plans to sell NEAR to head off the bubbles when the price becomes overheated and keep the market stable when the users start to panic due to price drops.

Comparison between USN and other algorithmic stablecoins

USN comes with its own unique features and incorporates the features of some other algorithmic stablecoins. The initial supply of USN is issued by the Reserve Fund via the double over-collateralization of NEAR and USDT. This is slightly different from the issuance mechanism of DAI, which is minted by collateralizing an amount of ETH that’s worth twice the value of the DAI to be minted.

A controversial aspect of UST is that the UST minted would be more valuable if the LUNA price soars. Meanwhile, the LUNA supply would go down, which would drive up its price, thereby creating an upward spiral. However, once LUNA goes downhill, redeeming LUNA with UST would lead to a LUNA crash, giving rise to a death spiral. Unlike the non-collateralized UST, the NERA spent on minting USN is not directly burned or erased from circulation but enters the USN Reserve Fund instead. The Reserve Fund then stabilizes the market in advance through Automation of Treasury Management to avoid any excessive price impacts that the USN supply may have on NEAR. Apart from NEAR, USN is also partially backed by USDT. UST, on the other hand, is backed by Luna Foundation Guard, which holds reserve assets such as Bitcoin and AVAX that are highly correlated with LUNA. As such, when the market declined, Luna Foundation Guard failed to help UST maintain its peg. From the perspective of collateral, USN is, to a certain extent, more like FRAX, a fractionally-collateralized stablecoin.

Could USN avoid the death spiral?

As of May 31, the USN supply is worth $108 million, while NEAR features a $4.3 billion circulating market cap, a $6.1 billion FDV, and a $607 million 24H trading volume. Compared with NEAR’s market cap and trading volume, the risk facing USN is still manageable. In addition, when USN is issued, the Reserve Fund, based on the Currency Board principle, will receive a corresponding amount of NEAR or other stablecoins. It automatically balances to maintain a backing of $USN at a rate greater than 100% at all times. Therefore, under normal circumstances, a serious USN de-peg is unlikely to happen.

However, as the USN supply expands, users can only mint USN with NERA, which means that the Reserve Fund may not necessarily have the equivalent amount of stablecoins. If the Reserve Fund failed to swiftly respond to a huge price drop of NEAR under extreme circumstances, then USN could lose its peg, and plenty of holders might find it hard to redeem their USN: converting USN into the equivalent value of collaterals.

As such, to get prepared for the impact of extreme circumstances, USN must increase the income of the Reserve Fund via such methods as minting fees, Automation of Treasury Management, and NEAR staking revenue. Meanwhile, the supply of USN should be capped to avoid the generation of excessive bubbles when the market overheats, bubbles that would be an unbearable burden if the market turns bearish.

Conclusion

No algorithmic stablecoin is perfect, and USN also has its pros and cons. Fortunately, NEAR’s USN witnessed the historic Terra/UST meltdown during its infancy, which gave a strong warning to the developers and users of USN. In terms of such factors as the current supply and collateral reserve, USN is unlikely to run into a death spiral. However, as the stablecoin becomes more widely adopted, the supply will expand, and the risk of a death spiral will increase. By then, USN will face more challenges.